Why need a coldwallet RMB payment card?

Release time: 2021-07-01

Sources:

Has been browsed 1957 times

The central bank’s motivation for issuing digital renminbi has long been subject to many outside speculations. Mu Changchun, director of the Central Bank’s Digital Currency Research Institute, clearly explained two reasons for the central bank’s issuance of digital renminbi at the second quarter of the Bund Financial Summit held on October 25. The historical trend of currency development and changes in cash demand.

1. Every technological advancement in history has spawned a game between private casting and official currency. The issuer of private currency decides the weight, fineness and standard of the coin, which increases the social cost. In recent years, global stablecoins such as Bitcoin and Libra are also trying to play the role of currency. These encrypted assets are used to process payment transactions in a decentralized manner, which will erode the country’s monetary sovereignty. Therefore, the digital pressure of cash is increasing.

2. The absolute use of cash is still growing, which shows that the digital supply of legal tender in retail has not kept up with changes in demand, especially in remote mountainous areas and poor areas, where financial services are insufficient, and the public is highly dependent on cash. For some digitally disadvantaged groups, such as the elderly who do not use smart phones and those who exclude the use of smart terminals, the development of electronic payment has not only failed to improve financial inclusiveness, but financial exclusion has emerged. Currency is originally a public product that serves all groups in society. The central bank should provide inclusive, easy-to-use, and digital central bank currency for all people, including poor areas and disadvantaged groups.

In further analysis, nowadays, third-party payment tools such as Alipay and WeChat are increasingly pursuing the "exclusivity" of payment scenarios under fierce competition, which has brought a lot of inconvenience to consumers. The introduction of digital RMB and independent APPs has It is conducive to breaking retail payment barriers and market segmentation, avoiding market distortions, protecting the rights and interests of financial consumers, and promoting inclusive finance.

When the new crown epidemic basically ended this year and work resumed in full, many governments launched consumer vouchers to stimulate citizens' desire to consume, but most of these consumer vouchers were issued through Alipay and WeChat. Shenzhen launched a digital RMB red envelope campaign in early October. It reflects that in the future, local governments will have the ability to directly contact citizens' payment accounts through the digital RMB APP, which can reduce their reliance on third-party payment tools and enhance their autonomy in economic regulation.

Digital currency card layering

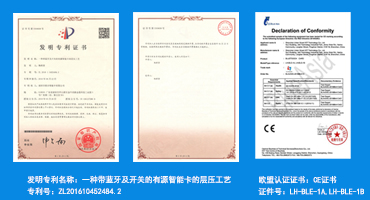

Shenzhen Union Smart Card Co., Ltd. has an invention patent—cold sealing card technology: financial visual card processing, financial visual card packaging, Bluetooth card sealing, visual financial card lamination, electronic hard wallet, virtual currency card, digital RMB, electronic cold chain wallet, digital hard wallet, Bluetooth visual card, blockchain card.

United Smart recently launched a new digital currency card product. The card integrates a security chip and an electronic ink screen, which can display the balance and consumption amount in real time, and also supports Bluetooth and NFC functions.